In German, it’s Projekt Angst.

In French, it’s Projet de Peur. In Italian, Progetto di Paura.

They all mean the same thing. Project Fear. Otherwise known as the efforts the establishment will go to in order to scare the population into voting the “right” way.

We had our own taste of it here in Britain during the run up to the referendum. For me, the peak was Donald Tusk claiming a vote to leave the EU would be “the end of Western political civilisation”.

I’m not sure how any democratic vote can be the end of a political civilisation. You may not like the result, but that doesn’t invalidate the process. The end would be to stop people voting at all. (Note: Donald Tusk was elected by the European Council, not directly by the people.)

But our own version of Project Fear will pale in comparison to what we’ll see in Europe next year. We got a taste of what it’ll feel like yesterday, when the European Central Bank released this warning in its twice-yearly Financial Stability Review (emphasis added mine):

More volatility in the near future is likely and the potential for an abrupt reversal remains significant. Elevated geopolitical tensions and heightened political uncertainty amid busy electoral calendars in major advanced economies have the potential to reignite global risk aversion and to trigger a major confidence shock.

“Political uncertainty” is something of a euphemism. “The bowel loosening terror felt by the political elite when they realise the people may vote against them” is probably closer to the mark.

The stakes couldn’t be higher. Britain’s vote to leave has directly challenged the EU. The underlying problems behind the crises we’ve seen in the eurozone have not been fixed. The banking system is still fragile. And now virtually every European nation has a political upheaval on the horizon.

That struck home for me earlier in the week during our “2017 Wealth Summit”. We were discussing Italian banks, specifically the fact that many of them have increasing numbers of bad loans on their books. Tim Price has been warning about this all year.

But it was Eoin Treacy of Frontier Tech Investor and Trigger Point Trader that really nailed the point. In the space of about 30 seconds, he rattled off the different European nations with upcoming votes.

Variously, these are Italy (a referendum which could topple the government in less than a month); the next round of the Austrian election (on the same day); and then Dutch, French, Hungarian and German general elections next year. Perhaps I should publish a Capital & Conflict calendar with them all pre-marked on. It’d be dim reading. A countdown to crisis! (But what a Christmas present that would be…)

There’s plenty of opportunity for the trend of anti-establishment votes to continue. It’s unlikely every single one will result in a repudiation of the status quo. But there’s a clear anti-establishment trend in Britain and the US. If that continues in Europe, we really will see some volatility. To the European political establishment, those votes are like drums, drums in the deep…

That’s not necessarily a bad thing, by the way. As Tim Price pointed out, markets might be good at pricing financial assets but they’re awful at figuring out what political change means. Perhaps because change means different things to different people. So really you’re trying to price people’s belief in a particular narrative, which is hard to do.

That creates volatility. But it’s not necessarily something to be scared of, though expect the powers that be to try. Volatility can be measured and controlled. I can show you how – how to know specifically what’s “normal” for each stock you own so you can make a more reasoned decision about how much to buy and when to sell. I’ll tell you more about that another time. In the meantime, if that sounds interesting, just email me with the subject line “volatility” and let me know if you’re interested. My email is [email protected].

While European banks suffer…

An interesting idea came out of our 2017 Wealth Summit. More than one actually. I’m still working on the edits so I can’t show you the full session just yet. But one particular idea is relevant to this conversation.

There was a clear difference in the way our experts talked about the banking system. There’s what’s happening in Britain and the US, and then the disaster that is the European banking system.

In fact, Akhil Patel, Charlie Morris and Eoin Treacy are all looking at buying the UK and US banks right now.

For Akhil that’s because banks are at the heart of credit creation, which is a key element to the property cycle. If the property market is about to soar, banks could well be at the heart of it.

For Eoin, it’s a story about deregulation and infrastructure in the US. Again, you’d expect banks to be at the heart of this. That, and the fact banks are cheap and have momentum behind them.

For Charlie it’s another idea. And that’s the fact that (good) banks like falling bond prices.

The first point to clarify here is that not all banks are created equally. There are good banks and bad banks: it all depends on how well they’ve dealt with the aftermath of the financial crisis, which is largely a function of geography. In this case, that means focus on the US and Britain like I said.

But Charlie believes good banks, quality banks, could well outperform. That’s because “banks are the opposite of bonds”: as bond prices rise, banks fall.

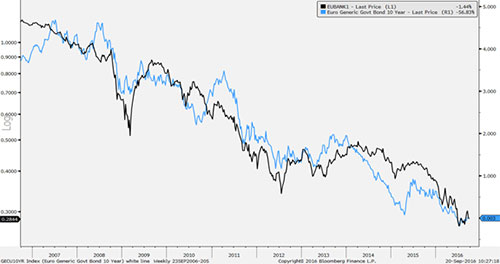

Want proof? See the chart below, which Charlie used to explain the idea at our conference earlier in the year. It shows bond yields in blue – remember, as bond prices rise, the yield falls. The black line shows European banking stocks’ performance relative to the wider market. If the line falls, it means banks are underperforming:

Source: Bloomberg

The two lines move almost in lockstep. As bond prices rise, meaning yields fall… banks underperform. It’s a logical idea when you stop to think about it. Falling bond yields hurt the banks’ profit margins. That translates into shares underperforming.

Why’s that important? Because it proves that banks are the opposite of bonds!

Rising bond prices (falling yields) = bad for banks.

Falling bond prices (rising yields) = good for banks.

Bond prices have been rising for the best part of 30 years. That trend seems to be in the early stages of reversing, as I’ve shown you. In Charlie’s view that makes it time to look at the banks.

Three different experts, coming at the market from their own experiences and strategies, coming to the same conclusion. It was a compelling argument for me.

And to be honest, it’s a compelling argument for signing up to receive Charlie, Eoin, Tim and Akhil’s work. I can show you what they’re thinking and how they’re seeing the world. We can observe what’s happening, think about it and come to a decision about what to do here. But to act – to pull the trigger – I think you need to be hearing from these guys on a regular basis. That way you get their full analysis on an investment recommendation, the risks and the potential rewards, plus updates on the position and sell advice when it’s time to get out.

I’ve been working on a way you can access Charlie’s “2017 money map” of where to invest next year. I’ll share it with you next week. Look out for it.

Have a great weekend,

Nick O’Connor

Associate Publisher, Capital & Conflict

Category: Economics