Everyone who’s anyone (in the office) is talking about Chinese debt levels. It was all the rage, thanks to the most recent quarterly report from the Bank for International Settlements (BIS). And what a page turner it was!

I jest. But it’s a serious matter. The BIS says China’s 255% total debt-to-GDP ratio is part of the problem. But not all of the problem. “All” of the problem is China’s “credit gap”. What’s that?

That’s the gap between historic and current total debt-to-GDP ratios. China’s current gap is 30.1. BIS says a gap of 10% is cause for alarm. The alarm is that the country is buying short-term GDP growth with long-term debt. That’s how you get yourself a crisis.

The implosion method

But let’s reverse the conventional thinking about a crisis. Let’s say it doesn’t have to start at the periphery. Let’s say it starts at the core. How do you get a crisis from the core to transfer out?

It turns out it’s not that hard. And here you’ll have to forgive me my rough and ready knowledge of nuclear physics. Said knowledge is derived from barely passing physics in high school, and then watching seasons one and two of Manhattan, a fictional TV show about the making of the atomic bomb in Los Alamos, New Mexico.

Most of the characters in Manhattan are fictional, albeit based on real people. As far as I can tell, though, the science is real. And that brings me back to the implosion method. It’s the bomb design that eventually won out and was used in the weapons that were dropped on Hiroshima and Nagasaki.

The implosion method basically surrounds a piece of fissile material – the “fuel” in the bomb – with explosive material. The explosive material is detonated to compress the fissile material at the centre (the fuel). At a certain point, the fissile material reaches “criticality” and a self-sustaining chain reaction is set in motion that results in the splitting of an atom; an atomic bomb.

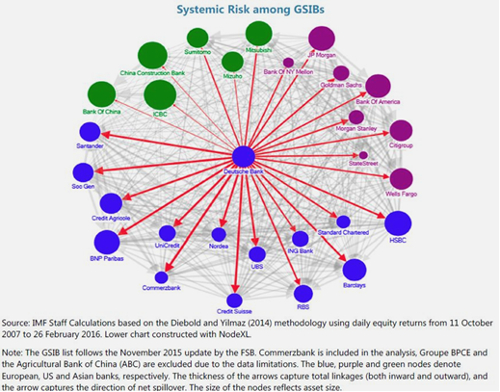

Now look at the chart below. It was published in June of this year in a report prepared about the German financial system by the International Monetary Fund (IMF). GSIB stands for “globally systemic important banks”. I’ll come back to what constitutes a systemically important bank in just a second.

Source: International Monetary Fund

Source: International Monetary Fund

Deutsche Bank imploding

Deutsche Bank’s shares are down 47% year-to-date. That includes today, after a new report said the bank could have to raise capital to pay legal fees and other costs associated with the $14 billion fine levied against it last week by the US Department of Justice in relation to mortgage-backed securities sold during the last financial crisis.

Mind you, it’s not a fine. It’s a bargaining position established by the US government. Odds are, Deutsche can haggle it down to €5 billion or so. But a report from an analyst at Societe Generale says that even a €5 billion fine would leave the bank “significantly undercapitalised.”

The bank would need to sell bonds or equity to raise capital to reassure shareholders and creditors it can survive the fine. All of that sounds existentially scary. But that’s not even the horror captured by the IMF chart. How could it get worse?

Read the fine print. The IMF says the thickness of the red arrows captures the linkage between Deutsche (at the centre) while the arrow itself captures direction. As you can see, all of the risks travel from Deutsche and to other banks in the UK, US and Asia.

“Too big to fail”

What makes Deutsche so risky is its level of interconnectedness. The leg bone is connected to the hip bone, etc. The level of complexity in the interconnectedness – and the magnitude of the financial connections – is what puts the German bank at the centre of it all.

For that reason alone, it’s one of those banks that is now called “too big to fail”. But let’s suspend disbelief for a second. Let’s allow ourselves to believe in a world where central banks aren’t in control and where undercapitalised institutions fail when a small fall in asset prices wipes out underlying equity. What then?

Germany is at the centre of the European financial system. And Deutsche is at the centre of the German financial system. Until now, that made it the least likely to fail in a crisis. The risks had to travel from the outside in, from the most highly leveraged borrowers inward.

That’s the “implosion method” of financial crisis, where the pressure from the periphery compresses the fuel in the middle. And then you get criticality. And then boom.

Boom prevention team

The Committee to Prevent the Systemic Boom has no official members since it’s a committee I just made up. But you know who I’m talking about. I’m talking about Haruhiko Kuroda, Janet Yellen, Mark Carney, and Mario Draghi. The central bankers of the world.

Here’s my point as we kick off the week: the only way to prevent a system implosion like what I’ve described above is to change the nature of the system.

I’ve called that idea “when banking dies”. It’s when central banks replace commercial banks as the primary creators of credit and money in the world. Lending and borrowing money still happen in the economy. I don’t mean the death of banking.

But the business of doing it – the profit you make in fractional reserve banking and lending – becomes a terrible business that only the government loves. The banks get nationalised. And the central banks take centre stage.

Category: Central Banks